Get access to exclusive offers

See how much you can save

Get access to exclusive discounts

Partnership announcement

Brisbane Leapmotor and Novated Lease Australia bring you exciting, tax-effective electric vehicle options.

Leapmotor’s innovative EV lineup combined with Novated Lease Australia’s expert leasing solutions means driving electric has never been easier or more affordable.

Whether you’re considering the Leapmotor C10 or other models, a novated lease lets you:

- Save on tax by paying for your vehicle and running costs from your pre-tax salary

- Bundle all costs — car payments, insurance, maintenance, and more — into one easy payment

- Tailor your lease to suit your lifestyle and budget

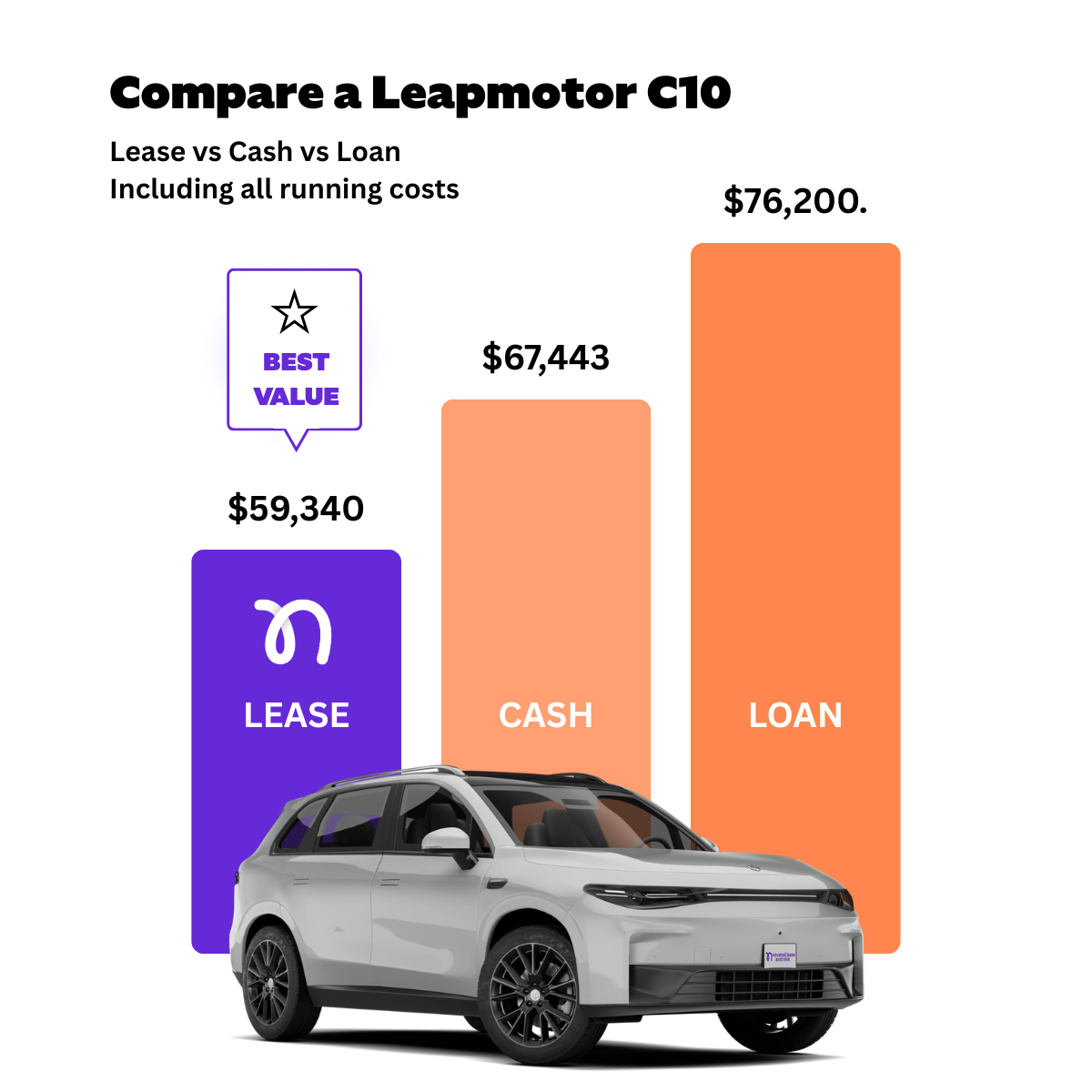

Compare a novated lease

Comparing the cost of a car plus running costs between a novated lease, cash and a regular car loan (comparison rate 7.2%)

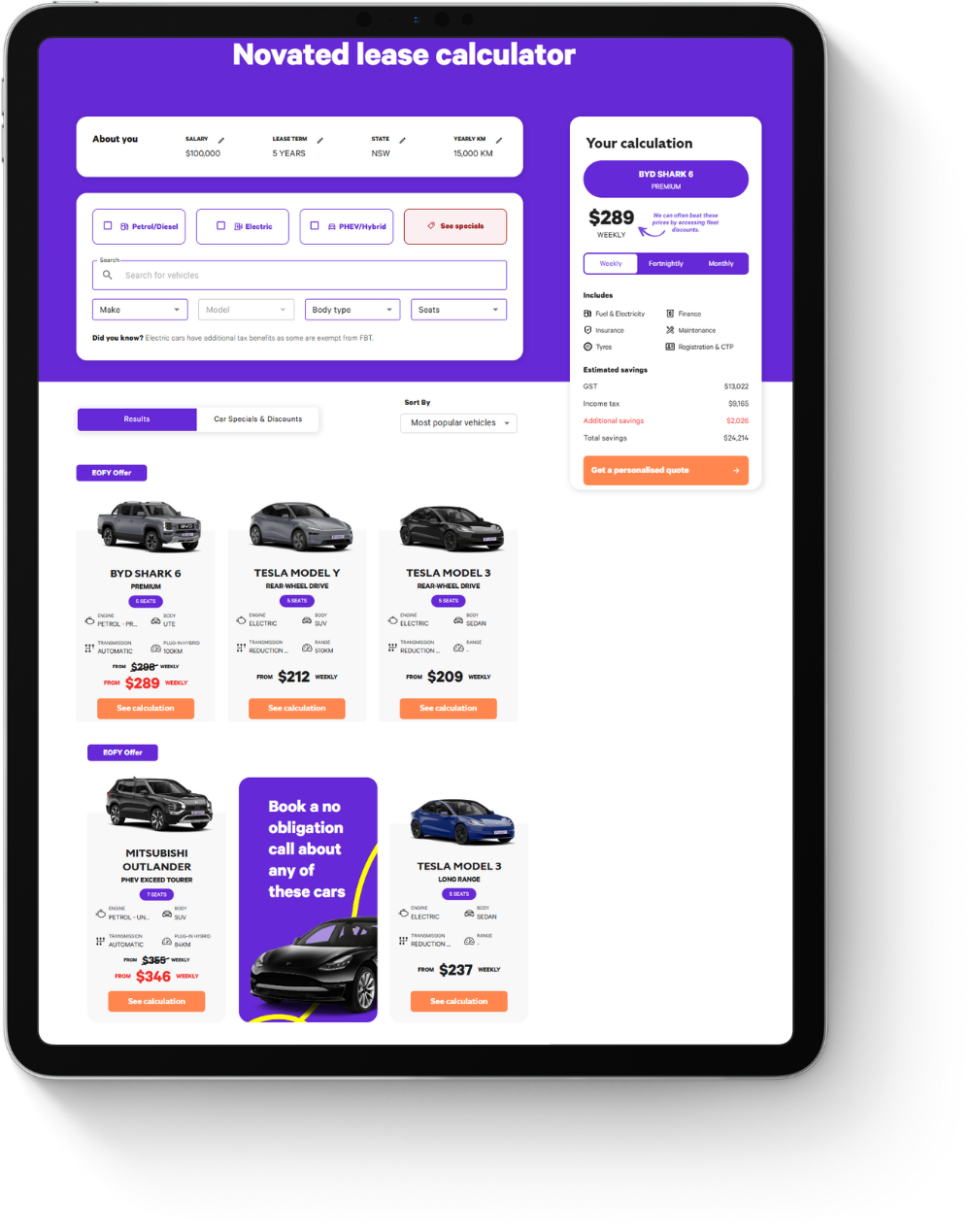

Novated lease calculator

See prices on over 1,400 different vehicles that are available to novate.

- Instant quotes

- Compare different makes and models

- Tailor specifically to your circumstances

How does a novated lease work?

Drive your vehicle

For a term of 1 - 5 years with unlimited KMs for personal use. There's $0 FBT on eligible models up to the luxury car tax limit.

Pay with pre-tax salary

100% of your payments are covered (including running costs) through your employer using your pre-tax salary. This reduces your taxable income and means you pay less income tax.

Save on GST

You’ll enjoy a GST discount of up to $6,334 on the purchase price of your vehicle, with a further GST saving on packaged running costs.

Quick-fire novated lease questions

Learn more about how a novated lease works from start to finish.

Is there a minimum salary to get a novated lease?

Novated leasing approval is dependent on your capacity as a borrower much like traditional finance. This means you need to illustrate your ability to meet regular repayments over the term of the lease.

For example, as it is entirely dependent on your personal living situation, expenses and dependents, you could gain approval for a $30,000 vehicle on a yearly salary of $45,000.

How long will my novated lease be?

The term of the lease agreement is flexible, to suit the employee.

Generally, terms of one to five years are available under a novated lease. You can compare your payments based on different lease terms using our novated lease calculator.

The shorter the term of the salary packaging agreement, the higher the residual.

What's the minimum and maximum value of car I can get?

The amount you can borrow for a vehicle will vary depending on the lender. In general, the minimum novated lease amount is between $5,000 and $10,000, while higher amounts are subject entirely to the repayment capacity of the applicant.

Novated lease agreements may exceed $100,000 but very rarely exceed $150,000.

Get expert answers to more of the common questions in our novated lease explained guide.

Can you help me get a novated lease anywhere in Australia?

Can I buy a used car with a novated lease?

Yes, right now, people more than ever are getting used cars through a novated lease instead of waiting for a new car deal. Buying a used car from a dealership will still see you save the GST on the purchase price.

Can I get a novated lease if I work for my own company?

Salary sacrificing a car through a novated lease can be suitable for a business owner who is also an employee of their own company, but it’s only an option if the business owner is receiving a salary from the company they own.

If you are planning to leave your current employment to start your own business, you can transfer your novated lease, provided you are paying yourself a salary.

If you are self-employed – i.e. are not paid a salary or paying yourself a salary through your own company – you will need to look at alternative forms of vehicle finance.

What happens at the end of a novated lease?

You have a few options available at the end of your novated lease term:

- Pay the residual amount (including GST) at the end of the lease term to own the car outright.

- Sell the car (either privately or through a dealer) and if the sale price is higher than the residual amount owing, you get to keep the profit tax free.

- If you want to keep the same car and continue enjoying the tax savings, we can help you to refinance the residual amount for another term.

What happens if I leave my current job during a novated lease?

If you leave your job during the term of your novated lease, or are fired from your position by the employer, you will still be responsible for making payments on the vehicle.

The lease will be de-novated, where the running costs are removed from the agreement and repayments work much the same way as a standard car loan.